Due to the ongoing COVID-19 movement restrictions, Shawbrook is making use desk-based valuations for some of their lending decisions. The appraisers that the bank is currently using perform these valuations using data points such as:

These valuations are very basic in nature and as a result the bank is currently not using these services across all its lending decisions leading to expensive ways of manual valuations and/or lost business.

Additionally, there is a growing sense within the business that lending decisions are highly subjective and they need be made more predictable irrespective of the personnel involved

To best address the challenges faced by customers, the key objectives to be met are:

Architect enterprise platform solutions in line with the governance framework to achieve all outlined deliverables detailed by IAGL utilising AWS, Azure and OpenAI

Work with internal stakeholders across the management team to agree on project requirements, build the enterprise architecture, delivery plan, governance framework and technical approach

As an SME, responsible for the strategic direction of the AI tools, solutions and governance to dictate the best approach to achieving business outcomes

Discussion and ideation of integrating existing architecture and security governance framework in line with company policy

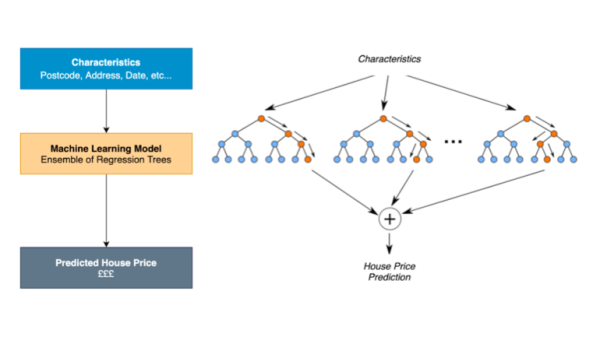

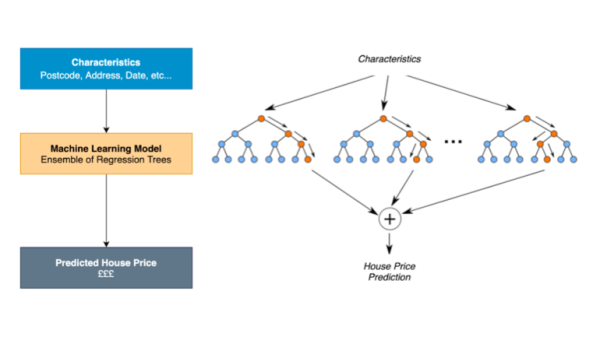

We developed an AI-driven Automatic Valuation prototype PoC that predicts market prices for all UK postcodes using up-to-date data, including crime rates, new school and transport data. This model overcomes the limitations of other models, which are typically based on historical data and charge banks on a per-query basis. It also allows for scenario planning and sensitivity analysis, providing Shawbrook with greater confidence in its lending decisions.

Our Automated Valuation Model accurately predicted house prices in London with (+/-5%) of both Zoopla and Rightmove.

A high level delivery plan including skills & roles required to take the project into production for the next phase.

Feature development included the expansion into commercial properties and integration of additional data sources such as:

This project branched into many varying aspects of engineering and technologies, and a few tools were used.